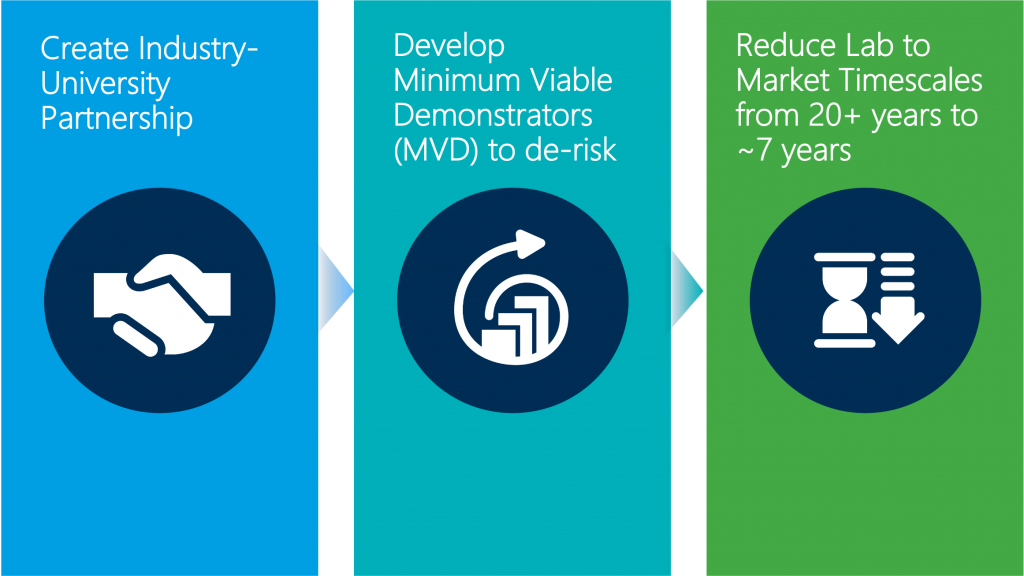

Key Benefits of the Partnership Model

Accelerate

- Brings breakthrough technology and industry users together to define essential proof points for successful translation

- Removes time between key development stages from lab to market

- Combines expertise in specifying and delivering industry-focused demonstrator projects

De-risk

- Focus on removing technology integration and scale-up uncertainties

Market focus

- Provides market ‘pull’, industry expertise and supply chain ‘buy-in’

University Partners Already Signed Up

Operating with its Hub at The University of Manchester, the Henry Royce Institute is a partnership of nine leading institutions – the universities of Cambridge, Imperial College London, Liverpool, Leeds, Oxford, Sheffield, the National Nuclear Laboratory, and UKAEA. Royce’s associate partners are the universities of Cranfield and Strathclyde. The Royce coordinates over £300 million of facilities, providing a joined-up framework that can deliver beyond the current capabilities of individual partners or research teams.

The University of Bristol is fifth in the UK for research excellence with 94% of its research assessed as world-leading or internationally excellent. From this research base, the University has an increasing reputation for innovation and delivering impact. In the last three years, the current portfolio of 74 active spin out companies – covering areas as diverse as gene therapies, medical devices, advanced materials and testing, quantum technologies, AI and security – raised over £1.1bn in external investment. A notable exit has been the acquisition of synthetic chemistry spin out Ziylo by global healthcare company Novo Nordisk in a deal worth up to $800 million.

Cambridge Enterprise is responsible for supporting the translation of University of Cambridge research to create globally leading social and economic impact. Managing investments made by the University of Cambridge Venture Fund, we have invested over £43 million in more than 158 companies across a wide range of sectors, with portfolio companies together going on to raise over £3.7 billion in follow-on funding since 1995. Notable spin-outs include natural materials-based alternatives to plastics B-Corp Xampla, high-power ultrafast-charging battery technology company Nyobolt and sustainable power electronics solutions firm Cambridge GaN Devices.

The Enterprise division of Imperial College London has been responsible for 290 staff and student startups from 2017 to 2022 and these companies have raised £609 million in external funding. Notable startups include ContextAI, Myricx, NK:IO, ProtonDx, Qaisr, Solena Materials, Biocentis, Permia Sensing, Toffee AM, Notpla, Fluus, Puraffinity, Gravity Sketch, Charco Neurotech, Multus, Fresh Check, Jelly Drops, Deploy Tech, Recycle Eye, Koalaa, Magdrive, Humanising Autonomy, Materialise X, and Petit Pli.

The University of Manchester Innovation Factory has been responsible for over 60 spinouts, including thirteen in the last year. It has recently made record annual licensing income (£7.4m) and closed the University’s largest ever IP licensing deal ($88m). Within the last 12 months investment in spinout companies also increased with £3.6 m of external investment being made in new spinouts, along with £41m of external investment in existing spinout companies.

Oxford University Innovation is the research commercialisation arm of Oxford University, supporting innovation and entrepreneurial activities across all University Divisions. We are helping the University to create a world-leading innovation ecosystem with Oxford University at its heart. Oxford University Innovation is the highest university patent filer in the UK and is ranked 1st in the UK for university spinouts, having created over 200 new companies since 1998.

UCL is currently involved with 75 active spinouts and has been responsible for raising £1.4b in external investment in the last 3 years. Within the last 12 months there have been significant exits from engineering spinouts Senceive Ltd (www.senceive.com) and Satalia (https://www.satalia.com/) following their acquisition by EddyfiNDT and WPP respectively. Also, Bramble Energy, a fuel cell spinout that manufactures PCB fuel cell stacks and systems recently raised a £35m investment round.